5 September 2023

Mastering Elliott Wave Theory for Forex Trading

Education

As you will discover, the forex market ebbs and flows in some predictable patterns. The patterns leave money trails, zones, and levels, which professional traders use to predict the direction of the market and assets.

If you cannot spot these patterns and money trails, you might need to revisit your Forex 101. However, a range of tools help you easily spot forex patterns and make accurate decisions. The Elliott Wave Theory is just one of them, which is very popular among traders.

Introduction to Elliott Wave Theory

Elliott Wave Theory is an advanced technical analysis for detecting recurring price moves in financial markets. We explore the details of this popular theory and how you can use it to your advantage from forex markets below:

What Makes Elliott Wave Theory Unique?

The Elliott Wave is coined on the idea that financial markets move in repetitive cycles. Investors can correctly determine where the market will go by identifying these patterns. This is the essence of profitable trading using the Elliott Waves, making the model unique and appealing to traders.

Besides, the Elliott Wave can identify price movements on multiple timeframes (minutes, hours, weeks, months, years). The model suits different styles of trading, from intraday to long-term hedging. In other words, you will likely find Elliott Wave important regardless of your trading style.

Historical Background

By now, you already know why you should add the Elliott Wave Theory to your traders' toolbox. But do you know how this theory came into being?

The Elliott Wave Theory is the brainchild of the great thinker and accountant Ralph Nelson Elliott. Interestingly, before Elliott, financial analysts held conflicting views on how financial markets move. Some believed that stock market movements were erratic and chaotic.

Inspired by the natural waves of the sea, Elliott was ready to leave a mark traders would be proud of today. After analyzing nearly 75 years of stock data, Elliott developed the Elliott Wave Theory in the 1930s. He presented these findings in his book, The Wave Principle.

The theory is based on the following principles and ideas:

Every action in financial assets is followed by a reaction – for each impulsive market movement, there is a corrective phase.

The price movement of financial assets is governed by natural laws induced by psychological currents and market events.

The upward and downward price swings reflect the emotions of investors and their collective psychology.

The theory grew more popular in 1935 as Elliott accurately used it to predict a stock market bottom. Since then, Elliott's principles and ideas have become popular among professional traders, investors, and portfolio managers.

The Basics of Elliott Wave Theory

Elliott Wave Theory suggests that market booms and busts occur repeatedly regardless of trader emotions and market conditions. That leads us to two fundamentals underlying this influential theory – motive waves and corrective waves.

Motive Waves

Motive waves are price movements that follow the market's or trend's direction. These waves are characterized by three impulse waves and two corrective waves along the main trend. The waves are premised on the idea that markets will always catch a break before making the next move.

The motive impulse waves move with the trend, while the corrective waves (market breaks) move against it. However, corrective waves happening on motive waves are usually smaller, while the impulse waves are longer to maintain the general trend. A diagrammatic representation of the impulse waves is shown below:

Fig 1: Impulse waves with three motive waves (1, 3, and 5) and two corrective waves (2 and 4).

To understand the impulse motive waves, these are some of the underlying principles and cardinal rules:

Wave 1 represents the beginning or initial movement. Assuming the trend is up, Wave 1 represents a moment when some traders start buying an asset when the price is still low, pushing it higher.

Wave 2 is when the market corrects slightly as traders take profits. The bottom of Wave 2 is always a higher low than the low of Wave 1. It can also be at the same level as Wave 1 but not lower.

Wave 3 is when a large group of traders decide to enter the market, pushing the price higher. The peak of Wave 3 must be higher than the high of Wave 1. Also, Wave 3 should never be the shortest impulse

Wave 4 forms as more traders make a profit while the asset price becomes expensive. Wave 4 cannot overlap Wave 1

Wave 5 happens when some more bullish traders buy the expensive asset. Although Wave 5 is expected to peak above the top of Wave 3, it can also end lower. Wave 5 could signal traders' exhaustion and a possible change in trend.

Corrective Waves

Markets do not always move in the same direction. Trends change from uptrend to downtrend and vice versa, depending on changing sentiment and market developments. Corrective Waves denote trend reversals.

From a trading perspective, Corrective Waves are difficult to catch as they violate established or confirmed trends. Nonetheless, the Elliott Wave Theory helps spot them easily based on three sub-waves: two corrective waves and one motive but weak wave. These are divided into three categories:

Zigzag formations

Flat formations

Triangle formations

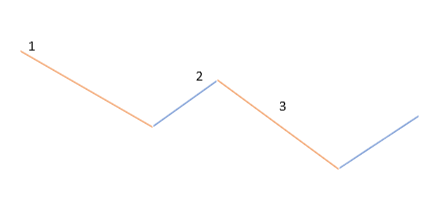

Zigzag formation

A zigzag formation occurs in three sub-waves, with a short motive sub-wave sandwiched between two corrective phases. Zigzags can happen multiple times in a row.

Fig 2: A diagrammatic representation of zigzag wave formation

Flat formation

These formations occur when the sub-ways are of equal length, depicting sideways corrective patterns. These waves normally occur after periods of prolonged or strong trends. The sub-waves tend to be smaller if the underlying trends are strong and vice versa.

Fig 3: A diagrammatic representation of flat wave formation

Triangle formation

Triangle formations are corrective patterns characterized by diverging or converging trendlines. The waves move sideways in a triangle structure. The triangles can be ascending, descending, or symmetrical.

The triangle-forming waves signal falling volumes and volatility. They also signal market indecision or a balance between supply and demand.

It is also important to note that triangle formations in the Eliott Wave structure are prolonged corrective phases. The market is majorly consolidating ahead of a trend continuation or reversal.

Fig 4: A symmetrical triangle in a corrective wave structure and breakout

Advanced Strategies for Implementing Elliott Wave Theory in Forex

Following the identification of waves, traders identify the likely market turning points, continuations, and reversals. But lest we forget, not every trade has a 100% chance of becoming a success. So, how do you turn those bad waves in your favor or reduce their impacts on your capital to have a happy ending in forex trading?

Risk Management with Elliott Waves

In the trading world, risk management involves managing your capital exposure on bad trades. You can manage risks using the Elliott Wave analysis in the following ways.

Correctly identify Elliott Waves

The key to trading successfully using the Elliott Wave is correctly identifying the waves. For instance, one of the observations in our earlier illustrations involving Motive Waves is that the movement forms a system of higher highs and higher lows. If you find Wave 2 (corrective) has a bottom lower than Wave 1 (Impulse), it signals something is wrong.

So before jumping into an Elliott Wave trade, ascertain that it follows the cardinal rules. Double-check the wave counts and interpret the patterns correctly. If you have doubts, you may cross-reference your wave impulses with other technical indicators, chart patterns, and price action.

For traders starting on the Elliott Wave, learning and testing the model before using it on your hard-earned cash is important. Demo trading is a good way to learn the intricacies and tricks of the Elliott Wave Theory. This way, you can learn how to use it correctly and overcome the downside risks.

Use stop-loss orders

Whether using the Elliott Wave or not, stop losses are crucial for managing risk exposure. A stop-loss order automatically closes a bad trade position at a small loss rather than letting the trade run into significant losses or trigger a margin call.

Based on the trader's analysis, stop losses are placed at levels the trade is unlikely to move to on normal price movement to cause a premature closing. For instance, in a triangle setup for a buy trade, the stop-loss order will be placed below the lowest swing of the triangle pattern.

Use position sizing and diversify your portfolio

Position sizing is another universal risk management rule in forex markets. It refers to the size of a position or dollar amount a trader takes on a given asset. The rule of thumb is to never risk more than 2% of your capital on a single trade.

Assume an investor has $10,000 in an account and wants to buy EURUSD. Going by the 2% rule, they should only risk $200 for the trade.

Traders should know that position sizing is a rule of thumb and can adjust it based on assessed risks, risk appetite, and trade conditions. However, going above 2% is considered a risky way of trading that can expose them to significant losses.

Similarly, diversification means a trader spreads capital in multiple assets and markets. This helps spread the risk from a single market or instrument. Position sizing increases the diversification ability by enabling a trader to take small but multiple-quality trades.

Monitor market events

Even with the best wave setups, market events can invalidate would-be successful trades, and by that we mean profitable. The biggest challenge for traders is to make the Elliott Wave Theory count in such scenarios. How?

Check and monitor the latest and upcoming Fed announcements, pronouncements, and analysts' chatter. Monitor market news and developments such as inflation data, employment, and geopolitics. Also, keep an eye on alternative assets like bond yields, which determine the demand for an instrument and its price.

By acknowledging and monitoring these market events, traders gain an edge over those who trade based on technical analysis alone. Fundamentals can help you adjust your trading decisions and mitigate risks if the market violates your wave.

Manage winners

You made some good Elliott Wave predictions, and the market rewarded you handsomely for your diligence. But when do you know it is time to run away with your green pips? Unfortunately, many traders can get glued to their winning trades and let them run forever.

You can use the Elliott Wave trading psychology to spot a trade that is losing steam and manage risks. An example is when a trade breaks any or some of the cardinal rules discussed earlier. So, what are you supposed to do?

You can fully or partially close your trade positions if you suspect the market to go against your favor. For instance, if you bought 3 lots or position sizes of an asset, you can close one lot and let the remaining two run. This way, you book some profits early on and reduce the risk exposure.

Pairing Elliott Waves with Fibonacci Retracement

Fibonacci Retracement is a popular tool used by Elliott Wave traders to identify market turning points. According to the model, markets will likely reverse and correct at specific areas based on Fibonacci ratios. These are 23.6%, 38.2%, 61.8%, 78.6%, and 100%.

Fibonacci retracement levels are dynamic resistance and support zones. In regard to the Elliott Wave model, Fibonacci levels are drawn, connecting the price points where major impulses have happened. In an uptrend, it is drawn by dragging the indicator from the price high to the price low and vice versa.

Normally, regular corrections happen at or between 50% to 61.8% Fib levels. For strong trending markets, corrections are sharper at 23.6% to 38.2%. Monitoring these Fibonacci levels can hint to traders when the next wave will likely start forming.

Case Studies and Real-Life Examples

There have been several successful examples of the use of Elliott Wave Theory. In 2017, some market analysts used the Elliott Wave Theory to call for a bubble top. The price went as predicted, hitting and dropping from a record high of almost $20,000 to $3,000. Please keep in mind that past performance is not a reliable indicator of future results

In another example:

How Elliott Wave Predicted XAUUSD Pair Movement

We took one example where the Elliott Wave played nicely on Gold (XAUUSD) to generate huge winnings for traders.

Source – TradingView (XAUUSD)

In the example above, the bullish cycle started at $1,620 on September 26, 2022, with the first wave finishing at $1,728. Notice how the price corrects back to $1,620 to confirm our Wave 2 at the same level as the low of Wave 1 but not below it.

See how the price of XAUUSD rapidly skyrockets from Wave 2 to make Wave 3 the longest and the most pronounced as per the Elliott Wave cardinal rules. The price attempted to move downward on the way to Wave 3, but buyers quickly pushed it higher before reaching the trendline.

The price corrects again to Wave 4 before taking another upturn to Wave 5. As you notice, Wave 5 becomes a little bit sluggish on buyer exhaustion and further profit taking. After Wave 5, the price of XAUUSD starts to decline, breaking below the ascending trendline.

From the example above, if you bought XAUUSD at or above $1,620, you will use the Wave 5 signal to exit before the start of the downtrend.

Pitfalls to Avoid

The Elliott Wave is not an all-in-all model as it can be complex and subjective in interpretations. To turn the model in your favor, avoid the following pitfalls:

Not considering other analysis

There is no one best forex trading strategy, not even Elliott Waves. So, if you are to use the Elliott Wave successfully, combine it with other technical analysis, indicators, and fundamentals. For example, you can use a trendline or moving averages to identify trends. Fibonacci retracements for corrections and reversals and many more. Also, monitor events that have the potential to change the market sentiment.

Not being consistent in the model interpretation.

Although there are cardinal rules to follow in Elliott Wave interpretations, traders can often be subjective. For example, some indicators may give conflicting signals with the Elliott Wave. Traders who vary their interpretation without sound reasoning can run into trouble. Having a consistent way to interpret the Elliott Wave model is the best way to protect your capital and trade longer.

Ignoring proper risk management

We indicated earlier that every trading strategy carries a chance to fail. Successful traders understand this and use proper risk management as their shield. The rule to never risk more than 2% of your capital, using stop-loss orders, and managing profits cannot be re-emphasized when using the Elliott Wave.

Succumbing to emotions and impatience

Many forex traders are reactionary and emotional. You may have entered a trade from a nice Elliott Wave setup but then see it turning against you. What do you do?

A couple of traders will succumb to fear and emotions and exit the trade at a loss, only for it to move in their direction afterward. This fear comes from the lack of belief in one's trading strategy.

Other traders will simply exit a trade early to book a few pips rather than let it hit their profit targets. Or they may jump on a trade too early before confirmations and make wrong entries.

The bottom line is that biases, fear, and greed affect our trading. The best way to overcome them is to gain a better understanding of the market and enter trades with confluence and confidence.

Conclusion and Takeaways

The Elliott Wave Theory is a powerful tool to analyze forex markets. The model has existed for nearly a decade and is used to identify repeat patterns in currency markets. Traders rely on recurring waves to determine the market direction and forecast the market turning points.

Since Elliott Waves can fail like other trading strategies, investors should embrace risk management, monitor market events, and use confluence to base their trading decisions. Investors should also avoid the subjective interpretation of waves, keep emotions at bay, and embrace patience. The strategies can help overcome Elliott Wave's shortcomings and increase the model's accuracy.

Disclaimer: Any information presented is for general education and informational purposes hence, not intended to be and does not constitute investment or trading or tax advice or recommendation. No opinion given in the material constitutes a recommendation by M4Markets that any particular investment, security, transaction or investment strategy is suitable for any specific person.

It does not take into account your personal circumstances or objectives. Any information relating to past performance of an investment does not necessarily guarantee future performance.

Trinota Markets (Global) Limited does not give warranty as to the accuracy and completeness of this information.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider.

1

1

Register & Verify your Profile

2

2

Open a Live Account & Fund It

3

3

English

English

简体中文

简体中文

Bahasa Indonesia

Bahasa Indonesia

Bahasa Melayu

Bahasa Melayu

Tiếng Việt

Tiếng Việt

ไทย

ไทย

Mexico (Español)

Mexico (Español)

Português

Português

日本語

日本語

Arabic

Arabic

한국어

한국어